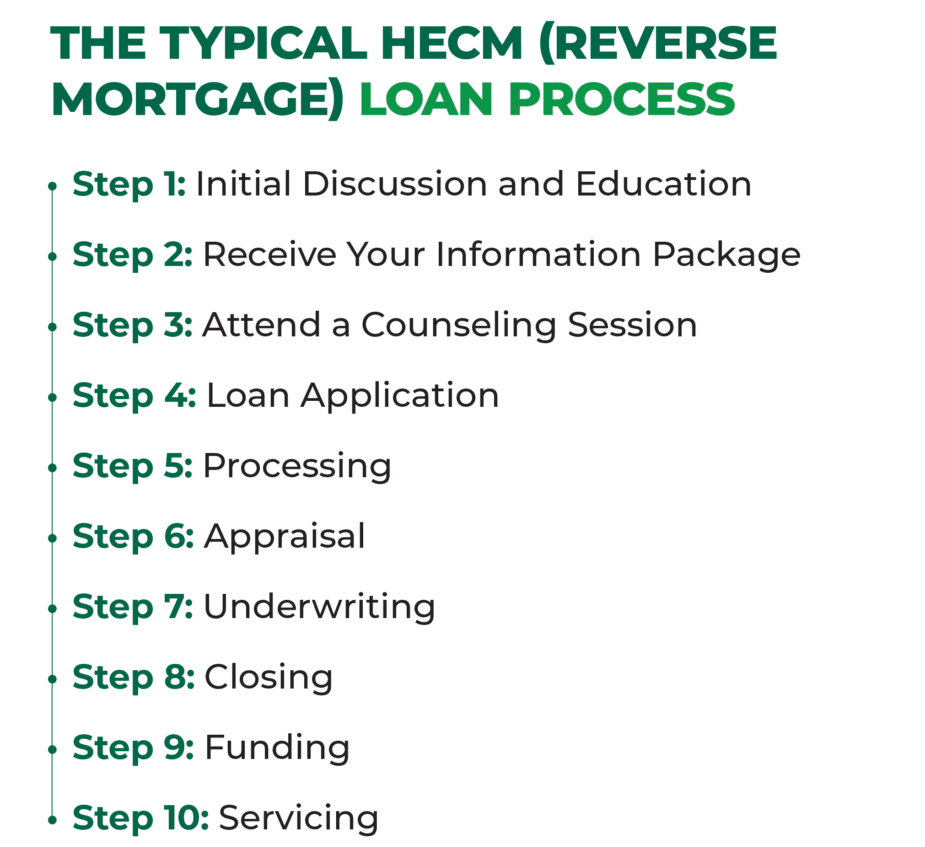

If you’re looking to empower your retirement with home equity, a reverse mortgage loan in Texas can be an excellent choice. At first glance, the process to get a reverse mortgage may seem a little intimidating or confusing, but it doesn’t have to be. Knowing what’s coming, being prepared and having an excellent lending team behind you helps ensure a smooth (and less stressful) borrowing journey.

For example, you can expect the reverse mortgage loan process (from application to closing) to take about 45 days, a timeframe similar to the loan process for most forward mortgages. In this article, we’ll cover other things you can expect, what a reverse mortgage loan is and a step-by-step breakdown of the typical reverse mortgage journey.

What Is a Reverse Mortgage?

The most popular reverse mortgage in the U.S., and the only one insured by the Federal Housing Administration (FHA), is a Home Equity Conversion Mortgage (HECM) loan. HECMs allow homeowners 62 and over to access a percentage of their home equity as usable cash and defer repayment of the loan balance into the distant future—generally until the last surviving borrower passes away or permanently moves out of the home. Like any other mortgage, with a HECM, the borrower must pay critical property charges, like taxes and insurance.

Depending on your situation, a “proprietary” or “jumbo” reverse mortgage may be a better loan option, especially if you own a higher-value home (one that’s worth seven figures) or live in a condominium not approved by the FHA. Note: This article only details the process for obtaining a HECM.

Step 1: Initial Discussions and Education

It’s wise to start by reviewing the HECM product with a licensed loan originator. Only FHA-approved lenders, like Fairway, are authorized to offer HECMs. You aren’t obligated to move forward—you’re simply exploring if a reverse mortgage is right for you.

You’ll likely have many questions, and a knowledgeable HECM professional will be able to provide answers. They’ll explain what you need to know, such as how reverse mortgage loans work, the loan requirements and how much loan proceeds you may qualify for.

Step 2: Receive Your Information Package

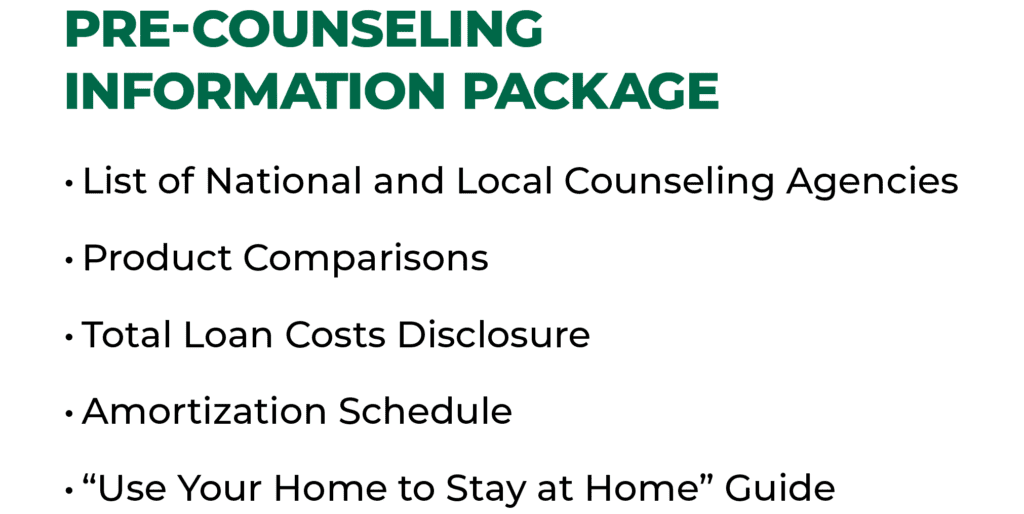

Once you decide a reverse mortgage is right for you, your loan originator will give you a pre-counseling information package including:

- A list of national and local counseling agencies (more on that in a bit

- A comparison of various product options

- A disclosure on the total costs of the loan

- An amortization schedule that describes the rate at which the loan accrues and other fees over time

- A helpful “Use Your Home to Stay at Home” guide produced by the National Council on Aging (NCOA)

Step 3: Attend a Counseling Session

As part of the reverse mortgage requirements, you’ll attend a counseling session. The main objectives of the counseling session are to make sure you fully understand the loan program and to help you determine if it’s a good fit for you.

Counseling is conducted by U.S. Department of Housing and Urban Development (HUD)-approved independent third parties. The session can be done in person or over the phone. Again, your loan originator will provide you with a counseling list of national and local agencies.

All borrowers and co-borrowers must attend the session. There are other situations where others also attend, such as a power of attorney (POA) for an incompetent borrower. The borrower’s family members are also encouraged to attend.

After completion, you’ll receive a certificate for you and all counseling participants to sign and date.

Step 4: Loan Application

You should contact your loan originator to complete the application, which is called a Form 1009.

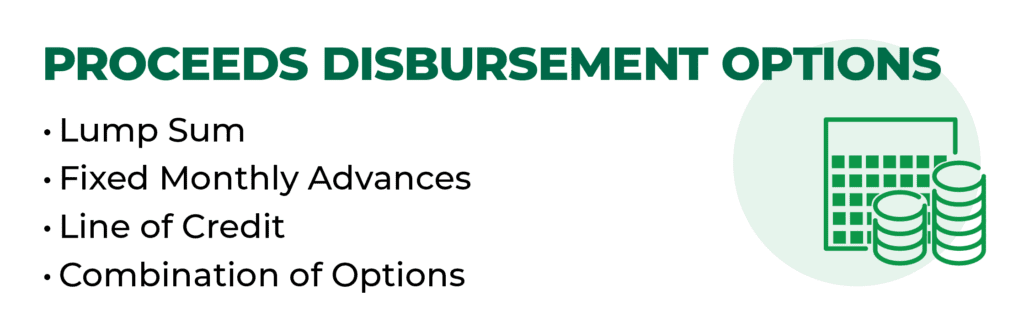

Similar to applying for a traditional mortgage, you must provide all requested documentation, such as proof of income and recent mortgage statements. Your lender will work on your behalf to collect other information needed to move the loan forward. During the loan application, you can decide how you’d like to receive your loan proceeds: A lump sum disbursement at closing, fixed monthly advances, a line of credit or a combination of these.

Step 5: Processing

Once all application requirements are gathered, your application and supporting documentation will be submitted to the processing team. The team will review your file and initiate the order of the third-party services, including the title report, appraisal, etc., and any other necessary verifications for completion.

The processing team ensures your file is complete and ready for underwriting review. Additional documentation may be requested to ensure your file is complete and sufficient according to underwriting guidelines.

Step 6: Appraisal

The home appraisal, done in person by an objective, qualified appraiser, is an essential step in the process, as it determines the fair market value of your home. The appraised home value, the age of the youngest borrower (or eligible non-borrowing spouse, if applicable) and the interest rate all factor into how much loan proceeds you may qualify for.

The appraisal also verifies that the home meets the minimum property standards set by the HUD.

While most appraisals will be fine, a second appraisal may be required to ensure that the first appraisal is accurate (in certain situations).

Step 7: Underwriting

Here’s when your loan will be approved, denied for a specific reason or approved with conditions.

While a HECM doesn’t require monthly principal and interest mortgage payments, the lender must evaluate your willingness and capacity to timely meet your property charge obligations, like taxes and insurance. The goal is to determine if the HECM will represent a sustainable solution for your financial circumstances. In certain situations, the lender may require that a portion of the loan proceeds be earmarked to pay property charges over a calculated time.

When your lender says you’re “clear to close,” the underwriter has reviewed and approved all the documents, and you’re ready for the next step.

Step 8: Closing

You’ll schedule and attend your loan closing. Depending on the lender, it may be done at different locations convenient to you, including from the comfort of your home. Make sure to review and sign the documents.

Step 9: Funding

HECMs for refinance have a three-day right of rescission, allowing you to cancel the transaction within three days of closing. The lender will release the funds after the right of rescission period. Any mortgages or liens against the property will be paid off at that time from loan proceeds.

Keep in mind it may take up to a week from closing for the funds to land in your bank account, assuming you are taking an initial draw at closing.

Step 10: Servicing

After your loan closes, a servicer will handle the daily administrative and management tasks related to your loan. Depending on the lender, the servicer may be the lender or a separate loan servicer specializing in HECMs.

Let’s Start a Conversation!

Here at Fairway, we strive to act first and foremost as educators. This way, you can make an informed decision about one of your most valuable assets: home equity. We understand that reverse mortgages tend to be a family decision, and we encourage open dialogue among you, your family, your financial advisor (if you have one) and our team.

At Fairway, we’re committed to making the loan process as easy as possible. We’ll be there every step—from the initial loan consultation to closing and beyond. If you’re interested in learning more about reverse mortgages in Dallas or throughout Texas, we can help. Connect with us today.