As a REALTOR®, when you help your clients realize their homeownership dreams, you also help them create long-term wealth. If you’re a homeowner, you have the kind of forced savings account you helped many clients establish: home equity.

In this article, we’ll explore:

-

Challenges REALTORS® face in retirement planning

-

Tapping home equity in retirement

-

What reverse mortgage loans are, and how they work

-

Common uses of a reverse mortgage

What Is a Reverse Mortgage Loan?

A Home Equity Conversion Mortgage (HECM, commonly called a reverse mortgage) is a home loan that allows homeowners aged 62 and older to convert a percentage of their home equity into cash or a growing line of credit. The borrower can defer repayment of the loan balance so long as they live in the home and pay the property-related taxes, insurance, and upkeep expenses.

Borrowers have several options for how they can take the loan proceeds:

- A one-time lump sum disbursement

- Fixed monthly advances (for a set number of months or for the life of the loan)

- A line of credit to use as needed

- A combination of the above methods

Note: This article only refers to HECM reverse mortgages, the most popular reverse mortgage product on the market and the only one insured by the Federal Housing Administration (FHA).

Challenges REALTORS® Face in Retirement Planning

It’s never too early to think about planning for your retirement. For most professions, the burden falls squarely on the individual worker to figure out how to save during their working years. While pensions haven’t entirely disappeared, employers are likely to offer a company-sponsored 401(k) retirement plan. However, most REALTORS® are independent contractors who lack access to company-sponsored benefits, like retirement plans and health insurance.

Furthermore, their incomes are deeply tied to commissions and fluctuate wildly based on macroeconomic factors driving the housing market. With today’s housing market, many REALTORS® are not making the money they used to, and some are outright struggling. For these reasons and more, it can be especially challenging for REALTORS® to meet their savings goals consistently and retire on time.

If you’re a seasoned REALTOR® approaching retirement, the window to accumulate savings from earnings is not as wide open as it once was. You may be worried about risks that can drain your savings faster than you ever projected and compromise your monthly cash flow and desired retirement lifestyle.

Spending surprises (e.g., unforeseen need to help family members, divorce, rising health care costs, home repairs and long-term care needs) can throw a wrench into a retiree’s cash flow strategy. Also, inflation—now a top concern for many seniors—can erode the purchasing power of savings over time.

To maintain your lifestyle as a retiree, you must determine how to convert your assets into sustainable cash flow for an unknown number of retirement years.

It can be wise to work with a financial advisor to prepare for post-working years. They can help you explore options like opening an IRA or 401(k) or taking on real estate investments and help you manage those assets throughout your lifetime.

Tapping Home Equity in Retirement

U.S. homeowners 62 and older have experienced impressive growth in home equity (now estimated at over $11 trillion). For most senior homeowners, the home is their single largest source of savings. So, when exploring viable options to help fund retirement, don’t overlook or dismiss the home—it’s often where the lion’s share of a senior homeowner’s wealth can be found.

While home equity is good, it’s of little functional value unless the home is sold or the equity is tapped. Most older homeowners prefer not to sell and move to fund their retirement and would rather age in the home they know and love for as long as possible.

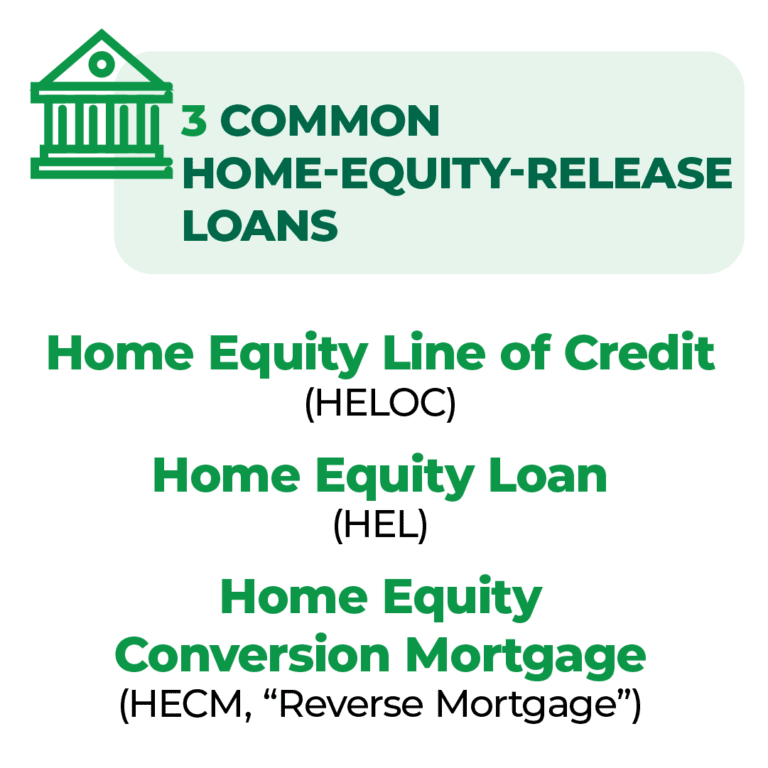

Access to a portion of the built-up home equity (while still living in the home) can be achieved via a home-equity-release loan. Three common types available for senior homeowners are the Home Equity Line of Credit (HELOC), Home Equity Loan (HEL) and the Home Equity Conversion Mortgage (or HECM, also called a reverse mortgage) loan. Though each loan uses the home as collateral and allows the borrower to use the funds for any purpose, they work in different ways and have different implications.

Of the loans mentioned, a HECM loan is the only one specifically designed for homeowners 62 and older and their unique needs. Check out our home equity loan comparison article for an in-depth look at the three loan types.

Common Reverse Mortgage Uses

What Is a HECM and How Does It Work?

A HECM is the only reverse mortgage insured by the Federal Housing Administration (FHA) and is the most popular reverse mortgage among homeowners.

It allows homeowners 62 and older to access a percentage of their home equity as:

- A single-disbursement, lump sum payout

- Fixed monthly advances for a set number of months or the life of the loan

- A line of credit

- A combination of these options

- Unlike other home-equity release loans, with a HECM, the borrower can pay as much or as little toward the loan balance each month as they wish, or they can opt to make no monthly mortgage payments at all (though they must live in the home, maintain it and pay property charges, like taxes and insurance).

The unpaid loan balance accrues interest and fees and eventually must be repaid. However, a HECM balance does not typically become due and payable until the last surviving borrower permanently leaves the home (e.g., passes away or moves into a nursing home), regardless of how far into the future that may be. The loan balance can also become due and payable if the borrower neglects their loan obligations, such as failing to pay property taxes in a timely manner.

When the loan is due and payable, it’s typically satisfied via the home sale. Neither the borrower nor the heirs will ever owe more than the value of the home when it’s sold to repay the loan. It’s what’s known as the loan’s non-recourse feature, and the FHA insures it.*

For a more in-depth look at the features of HECM reverse mortgages, check out our breakdown detailing how a HECM works.

It allows homeowners 62 and older to access a percentage of their home equity as:

- A single-disbursement, lump sum payout

- Fixed monthly advances for a set number of months or the life of the loan

- A line of credit

- A combination of these options

- Unlike other home-equity release loans, with a HECM, the borrower can pay as much or as little toward the loan balance each month as they wish, or they can opt to make no monthly mortgage payments at all (though they must live in the home, maintain it and pay property charges, like taxes and insurance).

The unpaid loan balance accrues interest and fees and eventually must be repaid. However, a HECM balance does not typically become due and payable until the last surviving borrower permanently leaves the home (e.g., passes away or moves into a nursing home), regardless of how far into the future that may be. The loan balance can also become due and payable if the borrower neglects their loan obligations, such as failing to pay property taxes in a timely manner.

When the loan is due and payable, it’s typically satisfied via the home sale. Neither the borrower nor the heirs will ever owe more than the value of the home when it’s sold to repay the loan. It’s what’s known as the loan’s non-recourse feature, and the FHA insures it.*

For a more in-depth look at the features of HECM reverse mortgages, check out our breakdown detailing how a HECM works.

The Advantages of The HECM Line of Credit

The most popular option to access HECM reverse mortgage funds, especially for a “planning” borrower, is via the line of credit. Here are the primary advantages of the HECM line of credit.

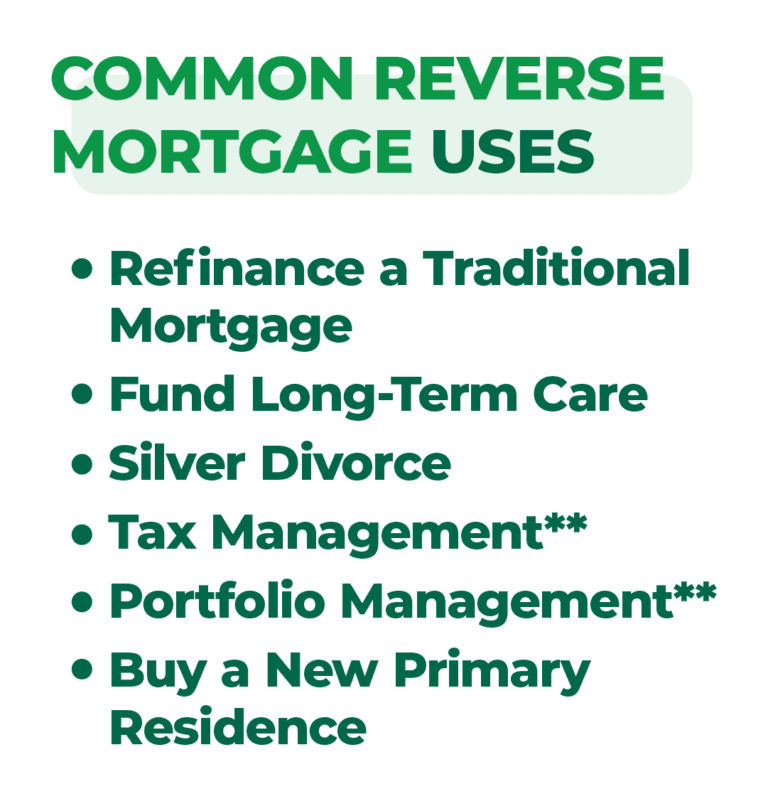

1. Refinance a Traditional Mortgage

Many homeowners 62 and over still carry a traditional mortgage. The cash outlay from the required monthly principal and interest mortgage payments can add up over time, diminishing cash flow during a phase in life when income is significantly less than during their prime working years.

Some borrowers refinance a traditional mortgage into a reverse mortgage to free themselves of the burden of fixed monthly mortgage payments. They are still responsible for paying property-related charges, like taxes and insurance.

Furthermore, you can use a reverse mortgage calculator to see how much you qualify for.

2. Fund Long-Term Care

Many people 62 and over don’t qualify for (or are priced out of) long-term care insurance (LTCI). Some borrowers use the HECM’s growing line of credit to help self-fund any future long-term care needs, while others use it to pay for the cost of monthly LTCI premiums.**

3. Silver Divorce

Divorce is becoming far more common among those 62 and older. Some separating couples use a HECM loan to divide assets, which can help one spouse remain in the home and help both parties avoid liquidating their productive retirement assets (like retirement portfolios) when dividing equity.**

4. Tax Management

Proceeds from a HECM generally aren’t taxable. Some borrowers use a HECM loan as a tax management tool to receive deductions when needed, withdraw less from IRAs and other taxable sources or strategically draw from the line of credit to stay in a lower tax bracket and potentially avoid tax on capital gains.**

5. Portfolio Management

Over the last decade, academic research has emerged on the strategic uses of reverse mortgages. The result is that homeowners and their advisors are now discussing ways to incorporate housing wealth into retirement planning decisions.

Some borrowers use a HECM loan to coordinate between spending from their investments and their reverse mortgage—to better protect their investment portfolio from market volatility.**

6. Buy a New Primary Residence

Many older-adult homeowners would like to downsize, upsize or rightsize into their dream home—or simply a new home that better meets their lifestyle in retirement.

Some borrowers buy a new primary residence using a Home Equity Conversion Mortgage (or reverse mortgage) for Purchase (H4P) loan instead of a traditional mortgage to finance part of the home’s cost. No monthly mortgage payments are required (must pay property-related taxes and insurance), so it feels like an all-cash purchase. However, they get to keep more of their retirement assets to use as they wish.

As a REALTOR®, you can gain a competitive advantage over other real estate professionals by being familiar with the H4P loan. For instance, H4P loans can help your 62+ clients increase their purchasing power to buy the home they truly want. For you, this could mean higher commissions and more sales and referrals. H4P loans also have less restrictive credit requirements, so you may be able to convert previously unqualified clients into happy homeowners.

In Summary

Looking ahead and developing a strategy that will support you during retirement is essential. Tapping home equity can help you create a more efficient retirement cash flow strategy and mitigate retirement risks like inflation and spending surprises. Knowing about H4P loans can also help you grow your REALTOR® business among homebuyers 62+. To learn more about reverse mortgages and if one may be a good fit for you, a client or a loved one, our Fairway reverse mortgage planners are here to help

Learn more about how a reverse mortgage could work for you

Please fill out the form below and we will be in touch.

*There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change

**This advertisement does not constitute tax and/or financial advice from Fairway.