Although it’s normal for retirees to carry some debt, it can loom over the financial freedom and security most aim for in retirement. If that debt reaches an amount that the retiree can’t cover while maintaining a comfortable lifestyle, it’s critical to find a creative solution as soon as possible.

For homeowners 62 and older, there is an innovative home loan that could help consolidate debt while increasing monthly cash flow: the Home Equity Conversion Mortgage (HECM).

What Is a HECM?

HECM stands for Home Equity Conversion Mortgage. It’s the most popular type of reverse mortgage loan in Dallas and throughout the state, and the only one insured by the Federal Housing Administration (FHA).

They allow homeowners 62 and over to convert a portion of their home’s equity into cash, accessible as a lump sum, fixed monthly payments, a line of credit where the unused portion grows over time (boosts the borrower’s line of credit for future use) or a combination of those options. The money is considered loan proceeds and not income, so it’s generally tax-free.*

The borrower still owns the home exactly as they did before the HECM, and there is no obligation to make monthly mortgage payments going forward. Instead, the homeowner simply has to maintain the home and pay the critical property charges, such as taxes and insurance.

If you’d like to learn more, check out this article about how HECMs work (and their pros and cons).

How Does HECM Loan Repayment Work?

Unlike a traditional mortgage or HELOC (Home Equity Line of Credit), HECM borrowers can pay whatever they want each month toward the loan balance. Many borrowers make no monthly payments (must still pay taxes, insurance and maintenance fees), while others elect to make voluntary prepayments for various reasons, such as potential tax advantages.*

The loan generally becomes due and payable when the last remaining borrower permanently moves out or passes away.

HECMs are non-recourse loans, meaning the homeowner isn’t responsible for mortgage debt that exceeds the home’s value. The FHA guarantees that neither the borrower nor the heirs will owe more than the home is worth when sold. If the home sells for less than the loan balance, the FHA’s Mutual Mortgage Insurance Fund (MMIF) covers the difference.

How HECMs Can Help Consolidate Debt

HECMs aren’t free. As with any home mortgage loan, there are closing costs, and the borrower must eventually repay the borrowed amount, plus interest and fees. And reverse mortgage loans in Texas are no different. However, several powerful HECM features make it a unique option to consolidate debt in retirement.

Eliminate Monthly Mortgage Payments While Owning the Home

For most Americans, their largest debt is their mortgage, and seniors are no different. Nearly 20% of homeowners 65 and older have monthly mortgage payments, something HECM borrowers can opt not to pay. They only need to cover property expenses such as taxes, insurance and home upkeep.

The HECM must be in the first lien position. Borrowers can use HECM loan proceeds at closing to refinance (pay off) their payment-required traditional mortgage into a payment-optional reverse mortgage. Plus, they can use any remaining HECM loan proceeds to pay for home renovations, pay off high-interest credit cards, pay for in-home care, establish a rainy-day fund or nearly anything they wish.

The average American homeowner pays $1,672 per month for their mortgage, which means this feature alone can be a powerful way for seniors to reduce their monthly cash outflow. If the homeowner has significant debt besides their mortgage, they can use the money that would otherwise go to monthly mortgage payments toward their most pressing debts.*

Consolidate Other Debts

Borrowers can use HECM loan proceeds to consolidate other debts (high-interest credit cards, auto loans, etc.), freeing them of the burden of those required monthly principal and interest (P&I) payments.

So long they meet the HECM loan terms, which include living in the home as the primary residence and paying the property-related charges like taxes and insurance, borrowers can continue to defer repayment of the loan balance. That can be a real game changer for your retirement cash flow strategy.

Flexible Payments to the Borrower

In many ways, a HECM is like an advance on the equity in a home. Proceeds from the HECM go toward any outstanding mortgage balance first, and the leftover funds then go to the homeowner. For those who own their homes outright, the potential HECM proceeds are even greater.

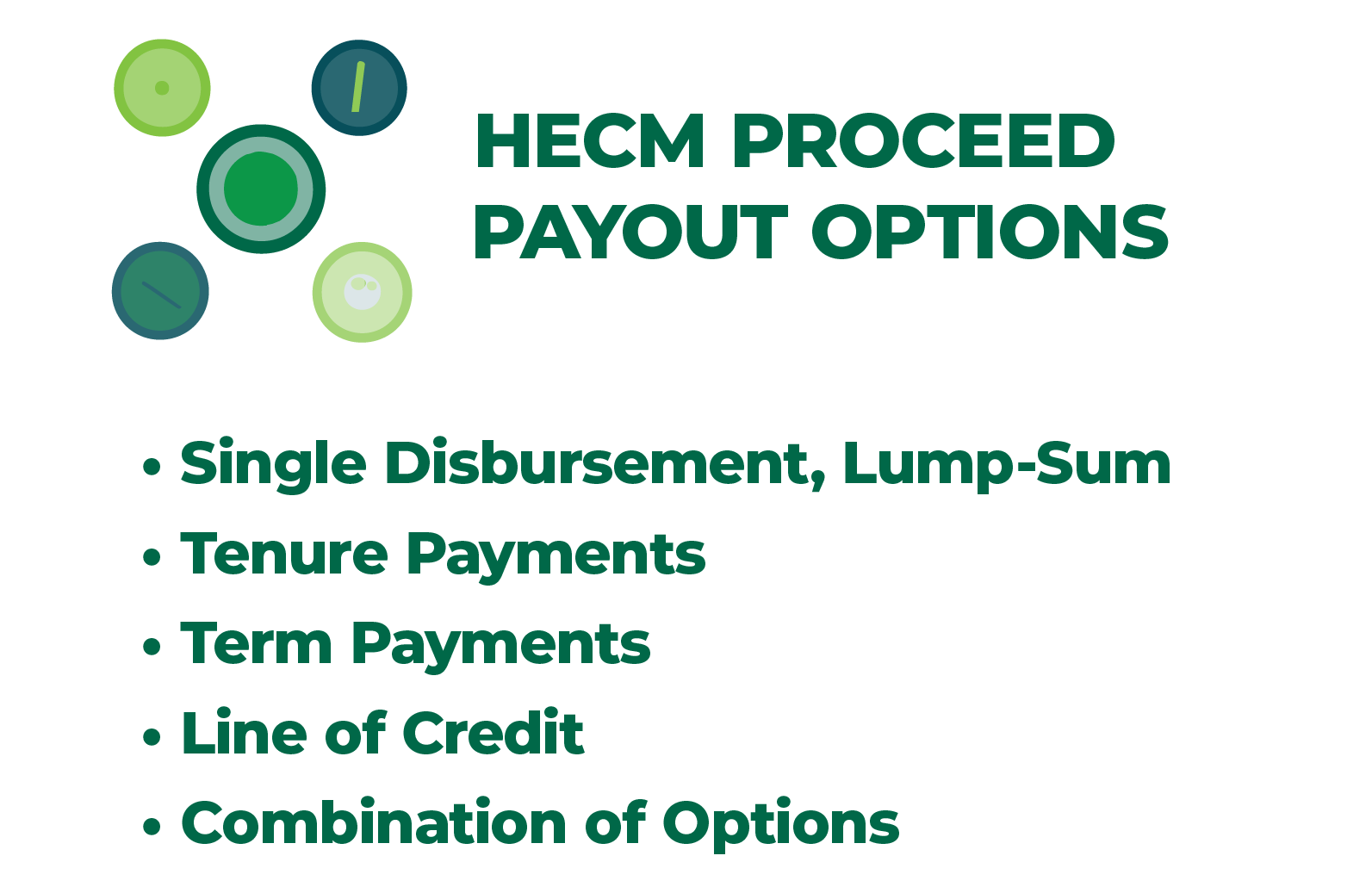

In either case, the borrower has a range of options in how they receive their loan proceeds, including a combination of the following options:

- Single disbursement, lump-sum

- Tenure payments (fixed monthly payments over the life of the loan)

- Term payments (fixed monthly payments for a set number of months)

- Line of credit where the unused HECM line of credit grows over time

The flexibility in payout options can enable senior homeowners to tailor their finances to their specific situation. Depending on the level and types of debt a HECM borrower carries, they can work with their financial advisor to map out the payout strategy that best tackles their debt.*

Shift Mortgage Debt From the Homeowner to the Home

As a HECM is a loan, it shouldn’t be viewed as free money to apply toward debts. However, if the HECM frees up enough cash to enable the homeowner to settle their debts, or at least make those debts manageable, it can greatly benefit the borrower. As the home sale typically pays the HECM loan balance once it matures, consolidating debt with a HECM is akin to shifting debt from the homeowner’s monthly cash flow to the home itself.

Safeguard Heirs

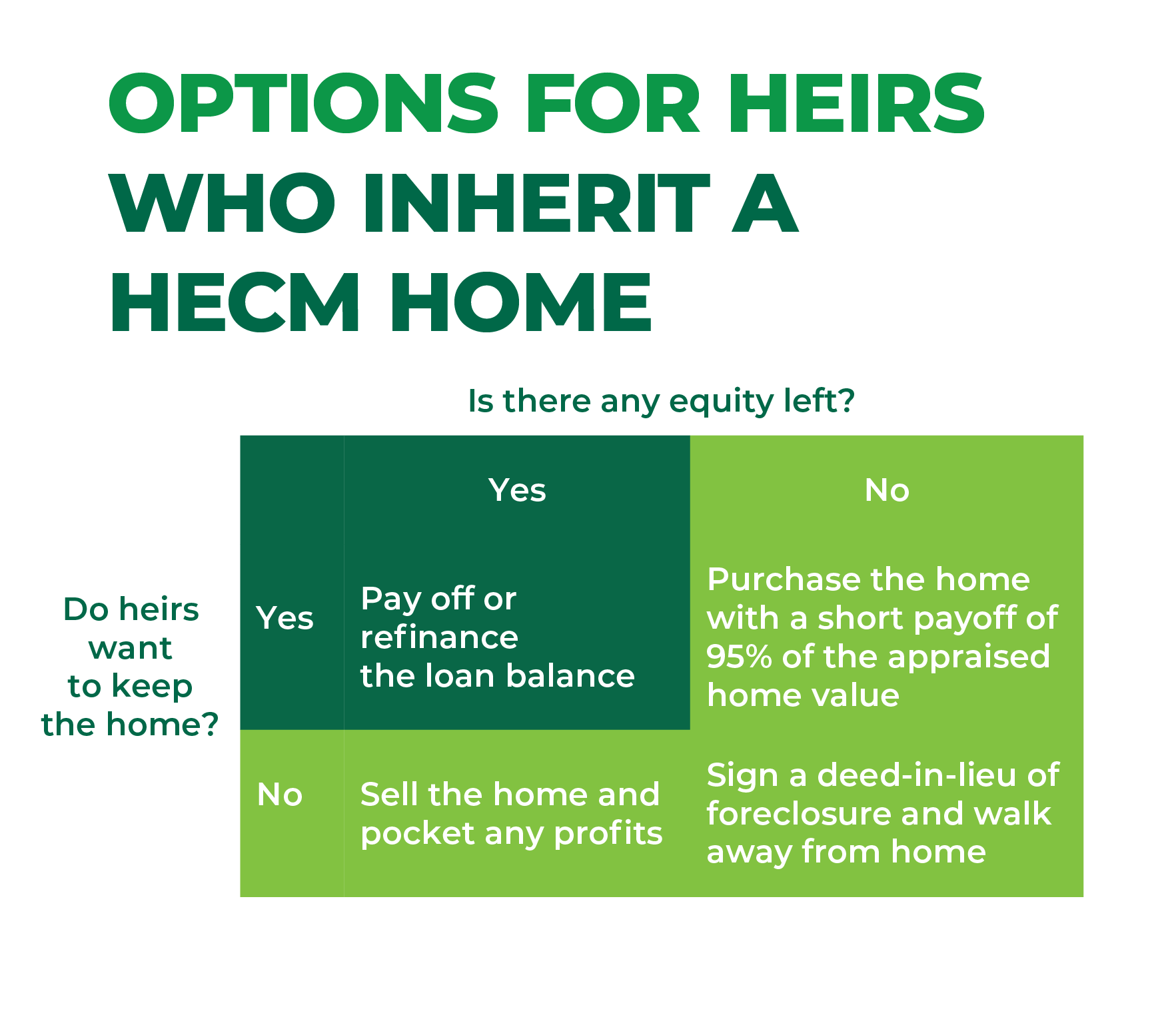

Another major difference between using a HECM to consolidate debt and a traditional loan product is the potential impact to heirs. As HECMs are non-recourse loans,** the borrower’s heirs will never have to pay out of pocket to satisfy the HECM because the home stands for the debt.

If the heirs don’t want to keep the home:

- Sell the home and pocket any profit

- Sign a deed-in-lieu of foreclosure and walk away from the home if the home is worth less than the loan balance

If the heirs want to keep the home, they can:

- Pay off the mortgage balance

- Obtain a short payoff of 95% of the current home value if the home is worth less than the mortgage balance

Pros and Cons of Using a HECM To Consolidate Debt

Much like any other loan, HECMs have their benefits and disadvantages, some of which are listed below. As with any large financial decision, it’s wise to consult a financial professional before committing to a HECM loan.

Pros of Using a HECM To Consolidate Debt

- The borrower retains full ownership of the home

- The borrower can pay off creditors,* potentially increasing their monthly cash flow for the things they need or want thanks to the flexible repayment feature

- Homeowners can eliminate obligatory monthly mortgage payments (must still pay property charges like taxes, insurance and home upkeep)

- If the homeowner’s mortgage payments are highly burdensome, the above feature can be incredibly useful for managing debt and increasing cash flow

- Flexibility for the homeowner to tailor their loan payout to best tackle their debt

- The home stands for the debt, protecting the borrower and heirs from personal liability for payment due to the loan’s non-recourse feature**

Cons of Using a HECM To Consolidate Debt

- The unpaid reverse mortgage loan balance grows over time, as interest and fees get added to the unpaid loan balance. Most other types of loans require monthly P&I payments, which decreases the loan balance over time and thus reduces your borrowing costs. Note: With a HECM, you do have the option to pay down the loan balance at any time, paying as much or as little as you like

- Fees and closing costs: The upfront costs tend to be higher for a HECM than other types of debt consolidation loans not secured by your home. Check out our article about a HECM versus a HELOC and HEL for more info.

- You’re drawing down on your home equity, which likely means your heirs will have less money (or no money at all) coming to them from that particular asset. However, by strategically tapping home equity first, you may be able to extend the life of your other productive assets, potentially leading to a greater net worth to leave to your family*

For seniors with debts that may be burdensome but are ultimately manageable, a HECM might not be the best option. However, for those with significant debt, especially if traditional home mortgage payments are a major factor, a HECM can be a powerful avenue to consolidate debt.

Are You Struggling With Debt in Retirement?

If you’re trying to solve a significant debt problem and are interested in a HECM, reach out to our specialists today.

*This article does not constitute financial advice. Please consult a financial advisor regarding your specific situation.

Copyright©2023 Fairway Independent Mortgage Corporation (“Fairway”) NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. These materials are not from HUD or FHA and were not approved by HUD or a government agency. Reverse mortgage borrowers are required to obtain an eligibility certificate by receiving counseling sessions with a HUD-approved agency. The youngest borrower must be at least 62 years old. Monthly reverse mortgage advances may affect eligibility for some other programs. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity.